Evidence of ESG in the Construction and Development Industry

Evidence of ESG in the Construction and Development Industry

As with many other sectors, environmental, social and governance (“ESG”) considerations are becoming imperative to the construction and development industry, and this focus on various aspects of health and sustainability has only been exacerbated by the COVID-19 pandemic and major climate events.

Recent focus on companies’ ESG data and investments in sustainability results from increased social and environmental consciousness in consumers, investors and other stakeholders. Such metrics cannot be ignored by industries dealing directly with the built- and lived-environment.

While the construction and development industry has had programs reflecting some of these concepts in its repertoire for years, new practices, programs and metrics are emerging – particularly in light of the global impacts of climate change and the ongoing pandemic. The use and implementation of ESG initiatives is expected to increase as governments and stakeholders become more focused on reducing emissions, improving project sustainability and providing greater investor stability. It is thus becoming a necessity for industry players to have policies and strategies in place to address ESG.

There are a variety of options available to owners and others in the construction and development industry looking to implement ESG strategies for their projects. The approach best suited, however, will depend on the goals of the business, the project nature and scope, the ESG metrics sought to be applied and how they are measured and implemented.

This bulletin summarizes some of the more prominent existing ESG initiatives and trends in Canada that industry players should be aware of as they look to develop their own ESG strategies.

Where ESG Meets Construction and Development

Given the nature of construction and development projects, it is unsurprising that they consistently engage the “three pillars” of ESG, albeit to varying degrees. For example, the applicable ESG considerations and metrics will change depending on the nature of the project (e.g., a new build versus retrofit), the stage of the project (e.g., design versus construction versus operation and maintenance), and whether it is the producers or the product being considered (e.g., the team running the project versus the materials involved). When undertaking procurement for construction of a project, owners may therefore actively seek contractors and suppliers who themselves have ESG strategies and policies, whose teams are diverse, whose products are renewable, ethically or locally sourced, and whose products ultimately contribute to a building that reduces carbon emissions. Similarly, developers seeking to attract investors for their projects may require strategies in place to ensure ESG is demonstrably incorporated and applied. As with the projects themselves, there is therefore no universal approach for ESG in construction and development at this time.

Recognizing that not everyone may wish to develop their own independent ESG strategies, owners and others in the construction and development industry may wish to instead implement one of the various ESG-related initiatives developed by industry-related and other organizations. Such initiatives each have their own nuanced focus and set of targets and, often, the parent-organizations administer a certification system to assess the progress or confirm the achievement of its standards based on a number of metrics (which can be quite technical and specific). Further discussion on such initiatives may be found below.

There is quite a bit of commonality between the metrics used by these initiatives – for example, energy efficiency / reduction of energy consumption, and reduction of waste and annual emissions footprint are common metric subcategories. In its 2020 report titled “ESG Investing: Environmental Pillar Scoring and Reporting”, the Organization for Economic Co-operation and Development (“OECD Report”) observed that such metrics can be broadly organised into the following: opportunities (transition to renewables), climate risk management (stress testing and mitigation), outputs (emissions and waste), inputs (resource use), and outcomes (ecology and biodiversity).[1]

In a more industry-specific commentary, Marsh McLennan provides the below graphic of the key ESG considerations in the construction industry.[2] Once again we see reference to efficiencies and reductions of waste and emission.

It is thus anticipated these common metrics will regularly be included in ESG initiatives developed by or for the industry and prescribed for implementation on construction and development projects.

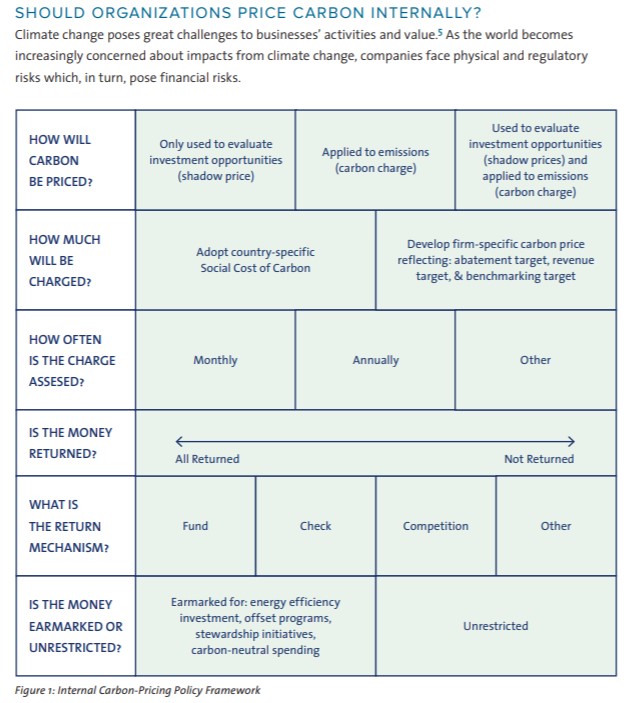

Notwithstanding the recognized level of consistency between ESG initiatives, there also remains high levels of inconsistency and subjectivity. As noted by the OECD Report: “several aspects of the E pillar within ESG rating methodologies suffer from high levels of inconsistency”, and “the use of metrics that relate to climate risk management, governance and opportunities in renewables can also leave room for interpretation and subjective analysis.”[3] For example, while reducing and managing carbon emissions in particular is a common metric subcategory across ESG initiatives, there appears to be no universally-accepted framework for pricing the cost of carbon (a.k.a., putting a cost on pollution). The following is an example of commentary and a framework for organizations to price carbon internally as proposed in a 2019 report by the Yale School of Forestry & Environmental Studies:[4]

Industry players who are becoming familiar with ESG initiatives and either looking to implement an existing ESG initiative or develop their own strategies should thus be aware of the potential differences in how ESG metrics are established and quantified and consider how this may ultimately impact key project metrics such as contract price, schedule, profit and profile on a project-by-project basis.

Examples of Key ESG Initiatives in the Canadian Construction and Development Industry

Construction and development activities have a clear nexus with and impact on the environment. As a result, the “Environmental” pillar of ESG has become a key focus in recent years, particularly with respect to improving sustainability and reducing impact.

Some of the most well-known organizations that promote and administer environmentally-focused building and operating initiatives for the construction and development industry include the World Green Building Council (“GBC”, and its Canadian contingent “CaGBC”); Green Building Certification Inc. (“GBCI”); International WELL Building Institute (“IWBI”); and Passive House Canada. These organizations focus on various facets of sustainability, including: ESG, energy, waste, sustainable sites, health and wellness, and resilience.

Two main industry initiatives from an ESG perspective, however, are LEED and the Investor Confidence Project (“ICP”) which are each summarized below.

(i) LEED

“LEED” stands for Leadership in Energy and Environmental Design. Certification by GBC / CaGBC and GBCI under this building standard evidences independent, third-party verification that the design and construction of a building, home or community incorporated strategies to achieve “high performance in key areas of human and environmental health: location and transportation, sustainable site development, water savings, energy efficiency, materials selection and indoor environmental quality.”[5] As such, LEED focuses not only on the construction of a project, but also on how it operates once complete. To attain LEED certification, a project is evaluated and given points for factors within nine basic categories: i) location and transportation, ii) sustainable sites, iii) water efficiency, iv) energy efficiency, v) materials selection, vi) indoor environmental quality, vii) innovation, viii) regional priority, and ix) integrative process. LEED is not restricted to new buildings or commercial buildings; it can be applied across all forms and sectors of projects, as well as all stages of projects including retrofit.[6] Notably, and as perhaps evidence of its contribution to ESG focus in the industry, Canada has been a leader in LEED development despite the initiative being voluntary, not locally or legislatively mandated. Well-known examples of buildings which have been LEED-certified by the Canadian Green Building Council include the Bridgepoint Hospital / Niagara Health System’s St. Catharines Site, Evergreen Brick Works, and Cadillac Fairview’s Yonge Corporate Centre.

(ii) ICP[7]

Where LEED standards focus on a project’s construction and operation, and are applicable to both new and retrofit projects, the Investor Confidence Project (“ICP”) primarily focuses on retrofit project financing activities, providing confidence of predictable savings projections and “a global underwriting framework” for evaluating energy efficiency of retrofit projects. ICP is administered by GBCI and, under ICP, projects can seek to obtain “Investor Ready Energy Efficiency” (“IREE”) certification, which recognizes that “projects have followed industry best practices and standards for baselining, savings calculations, commissioning, operations and maintenance, and measurement and verification planning.” ICP operates on the basis of “Commercial Protocols” which sets out best practices for energy retrofits, and “Project Development Specifications”, which sets out the requirements, tools, expectations and quality management. As with LEED, IREE certification is voluntary and not locally or legislatively mandated. Examples of projects that have been IREE certified include the Woodgreen Project (Toronto), and 301 Prudential Drive, Toronto, and a more comprehensive list of IREE-certified projects in Canada can be found here. In considering the commonalities in metrics between initiatives, the success of the IREE-certified Woodgreen project was noted to include consideration of i) annual savings in utility costs, ii) reduction of energy consumption, and iii) reduction of annual emissions footprint, which very clearly overlap with various of the nine LEED categories set out above.[8]

Notably, implementation of LEED or IREE for construction and development projects is not required by law and instead generally undertaken voluntarily by project owners. Some jurisdictions, however, have begun to institute mandatory standards relating to ESG factors. For example, those with projects in the City of Toronto will be familiar with the “Toronto Green Standard” (“TGS”), which establishes sustainable design requirements for new developments in the City.[9] The TGS consists of 4 Tiers of performance measures with supporting guidelines that promote sustainable site and building design. Unlike LEED and IREE, as part of the City planning application process, it is mandatory that a project at least meet the Tier 1 performance measures (such as with respect to air quality; energy efficiency, green house gasses and resilience; water balance, quality and efficiency; ecology; and solid waste). Given the increased prominence of ESG considerations, it is possible that more Canadian jurisdictions will follow suit and seek to create and mandate implementation of ESG strategies for construction and development projects.

In addition to the above, industry participants interested in improving their ESG initiatives and developing internal policies may benefit from reviewing IWBI’s WELL Building Standard; CaGBC’s Zero Carbon Building Standard; Canadian Home Builders’ Association’s Net Zero Home Labelling Program; and BOMA Canada’s BOMA BEST Program. While these foregoing initiatives are, like LEED and IREE, not legislatively mandated, stakeholders are likely to find themselves more frequently bidding for and managing projects which integrate ESG strategies and related certification as a requirement.

By way of example of how these initiatives are finding their way into project mandates, the following is a list of recent, high-profile project proposals which have included sustainability as an assessment criteria:

- Okanagan College Health Sciences Centre (British Columbia): This project is pursuing LEED Gold, the Zero Carbon Building Standard, and Silver Certification of the WELL Educational Pilot Program.[10]

- McMaster University Student Activity Building (SAB) and Fitness Expansion (Ontario): This project aims to incorporate a range of sustainability measures, including LEED Silver accreditation.[11]

- Red Deer Justice Centre in Red Deer (Alberta): This facility will be constructed to LEED Silver standards to ensure decreased energy consumption.[12]

- Saskatoon New Central Library (Saskatchewan): The new library is targeting LEED Gold certification and aims to incorporate sustainable strategies that minimize environmental footprints and improve the quality of spaces within the building.[13]

- South Niagara Project (Ontario): The South Niagara Project has been registered with the IWBI to work towards becoming WELL v2 certified.[14] If successful, and once the South Niagara hospital is open, the South Niagara Project will be the first WELL-certified healthcare facility in Canada.[15]

- Toronto Courthouse Project (Ontario): Seeking to achieve LEED Silver certification bolstering Ontario’s estate portfolio by ensuring the Project is environmentally responsible, universally accessible and efficient with its resources.[16]

- University of Toronto Student Residence (Ontario): A new residence hall at the University of Toronto Scarborough[17] will be one of the first in its category to be constructed to the Passive House standard.[18]

- Williams Parkway Fire Campus (Ontario): The City of Brampton is targeting LEED “Silver” and Fitwel building certifications.[19]

More on the “Environmental” Pillar of ESG: Recent Trends in Sustainable Materials

Complimentary to implementation of ESG strategies and metrics, in response to climate change the construction and development industry is putting greater focus on use of sustainable materials and management of the impact of their use on the environment. In fact, according to the Government of Canada,

“demand for more sustainable construction materials and methods, as well as more sophisticated design and production systems, is stimulating the construction market in Canada…”[20]

Two such market trends of which stakeholders interested in improving their ESG quotient should be aware are mass timber construction and low-carbon concrete production:

(i) Mass Timber Construction

Mass Timber Construction consists largely of engineered wood products (such as large panels, columns, or beams) and has been receiving increased attention for being a more environmentally-friendly alternative to carbon-intensive materials such as concrete. While it achieves a high-strength rating similar to concrete and steel, mass timber is much lighter in weight and is therefore ideal for light-frame and hybrid projects.[21] Currently, Canada’s national building code permits up to 12 stories of mass timber. The Federal Government points to various contributing factors explaining the rise in use of mass timber, including progressive building codes, innovate building systems, and an interest in green building materials and sustainable designs.[22]

(ii) Low-Carbon Concrete Production

Low-carbon concrete production uses tools and technologies to reduce carbon emissions from the highly carbon-intensive concrete production process. Based on buy-in by the Federal Government, it is possible that industry players will have additional incentives to adopt low-carbon concrete. The Federal Government recently announced a partnership with the Canadian cement sector with the goal of enabling the cement and concrete industry to achieve net-zero carbon concrete by 2050,[23] aligning with the Government’s “Greening Government Strategy”,[24] which aims to position Canada’s cement and concrete industry as a competitive global leader in low-carbon cement and concrete production and related technologies.[25]

Increased use of sustainable materials like those described above in construction and development projects is anticipated as ESG strategies become more prevalent, creating potential opportunities for those industry players ready and willing to use such materials.

Examples of Industry Players with Published ESG Strategies

As detailed above, many owners or others in the industry choose to use ESG strategies created by third parties, such as LEED. Industry players who are interested in instituting their own ESG strategies internally, however, are not without precedent.

In response to the growing demand by stakeholders and beyond, a number of companies are announcing their newly-adopted ESG strategies, including the following construction industry players:

- AECOM:[26] In a recent news release, AECOM announced the launch of “Sustainable Legacies”, its ESG strategy. As part of its strategy, AECOM lists 4 “key pillars”: achieve net-zero carbon emissions; embed sustainable development and resilience across its work; improve social outcomes; and enhance governance. As part of these pillars, AECOM has set specific targets – for example, under the first pillar, AECOM has set new 1.5°C-aligned emissions reduction targets and will be decarbonizing fleet vehicles (amongst other things).

- Webcor:[27] Webcor, a provider of commercial construction services, recently introduced a new “Corporate Social Responsibility” framework in order to integrate ESG considerations into its operations. As part of this introduction, Webcor has “renamed ESG: People, Planet and Performance”, which form the 3 categories of the company’s approach. Webcor’s website provides a transparent overview of the metrics under each of these categories, including the subcategories, hard targets, and responsible parties. For example, one of the subcategories under People is “Diversity & Inclusion”, and one of the targets is to increase underrepresented individuals within leadership by 25% by 2025. Under the Planet category, the subcategories include climate change and carbon emissions, waste management, transportation and travel, and community impact.

- It plans to enhance its companywide carbon commitment that, among other things, requires Webcor’s self-perform groups to: 1) collect Environmental Product Declarations for every product used in the construction of a structure by 2022 and 2) make informed procurement selections based on these low-carbon opportunities.[28]

Other companies of note that have recently announced ESG strategies include KPMG (“KPMG Impact”),[29] Hyatt Hotels Corporation (“World of Care”),[30] and Target (“Target Forward”).[31]

If you have questions or would like more information regarding ESG initiatives, including how to incorporate ESG strategies into your construction and development project, please reach out to the authors of this bulletin.

[1] Boffo, R., C. Marshall and R. Patalano (2020), “ESG Investing: Environmental Pillar Scoring and Reporting”, OECD Paris, at p.41.

[2] “David Kelly”, “Exploring the Impact of ESG on Contractors”, accessed online on July 27, 2021 at: Marsh McLennan.

[3] Boffo, R., C. Marshall and R. Patalano (2020), “ESG Investing: Environmental Pillar Scoring and Reporting”, OECD Paris, at p.42.

[4] Ethan Addicott et al, “Internal Carbon Pricing” Policy Framework and Case Studies” (2019) at 7, online (pdf): Yale School of Forestry & Environmental Studies.

[5] “LEED® Certification Process”, online: Canada Green Building Council.

[6] LEED® Website

[7] GBCI Canada website, accessed online on July 27, 2021.

[8] “Woodgreen Retrofit Project”, online: GBCI Canada.

[9] “Toronto Green Standard”, and Mid to High-Rise Residential & all Non-Residential Version 3, online Toronto.

[10] “Health Sciences Centre”, online: GEC Architecture.

[11] “McMaster University Student Activity Building and Fitness Expansion”, online: MJMA Architecture & Design.

[12] “Work set to begin on new Red Deer Justice Centre” (10 September 2020), online: rdnewsNOW.

[13] “Concept design unveiled for Saskatoon’s new central library” (31 May 2021), online: Saskatoon StarPhoenix.

[14] “South Niagara Project working toward first WELL® certified healthcare facility in Canada”, online: Niagara Health.

[15] Ibid.

[16] “Toronto Courthouse Project”, online: WT.

[17] “Pomerleau wins $106 million UofT Scarborough new Passive House student residence bid” (15 July 2020), online: Ontario Construction Report .

[18] Ibid.

[19] Ibid.

[20] “Mass timber construction in Canada” Government of Canada website, accessed online on July 27, 2021.

[21] “Mass Timber and Taller Wood Construction”, online: Naturally: Wood.

[22] “Mass timber construction in Canada” Government of Canada website, accessed online on July 27,

[23] “Government of Canada and Cement Association of Canada announce partnership to advance global leadership in low-carbon concrete production” (31 May 2021), online: Government of Canada.

[24] Ibid.

[25] Ibid.

[26] AECOM news release; accessed online on July 27, 2021.

[27] Webcore website, accessed online on July 27, 2021.

[28] Ibid.

[29] Michael Cohn, “KPMG Expands ESG Services” (7 July 2021), online: Accounting Today.

[30] “Hyatt Launches ‘World of Care’ with New Commitments to Advance Diversity, Equity, and Inclusion and Responsible Business” (14 July 2021), online: Bloomberg.

[31] “Target’s New ESG Initiative Proves Sustainability Is No Longer Optional” (23 June 2021), online: PYMNTS.

by Kailey Sutton and Annik Forristal and Srinidhi Akkur (Summer Student)

A Cautionary Note

The foregoing provides only an overview and does not constitute legal advice. Readers are cautioned against making any decisions based on this material alone. Rather, specific legal advice should be obtained.

© McMillan LLP 2021

Insights (5 Posts)View More

First pilot project in Quebec aimed at granting an advantage to enterprises hiring indigenous peoples for the performance of a public contract

First pilot project in Quebec aimed at granting an advantage to enterprises hiring Indigenous peoples to perform a public contract.

Introducing Bill 185, the Cutting Red Tape to Build More Homes Act, and an Update on the New Provincial Planning Statement

On April 10, 2024, Ontario’s provincial government introduced new legislation in its quest to “cut red tape”, speed up government processes, and meet its goal.

Consumer-Driven Banking is (almost) Here! Highlights from Budget 2024

On April 16, the Government of Canada released its 2024 budget which includes the promise of new legislation this spring to implement open banking in Canada.

Ontario Employers Beware: Common Termination Language Held Unenforceable

Ontario's Superior Court of Justice found that a termination clause was unenforceable because it gave the employer discretion to terminate "at any time".

Warning For Businesses: Companies Can be Liable for Tort of Bribery Even if They Did Not Intend to Pay or Receive a Bribe

Businesses with a duty to provide impartial advice must take steps to ensure the payments they make or receive are not later interpreted as bribes.

Get updates delivered right to your inbox. You can unsubscribe at any time.