One Year On: Economic Sanctions Have Become a Primary Tool of Canadian Foreign Policy and New Russian Sanctions are Imposed

One Year On: Economic Sanctions Have Become a Primary Tool of Canadian Foreign Policy and New Russian Sanctions are Imposed

Canada continues to take a strong stance against Russia’s invasion of Ukraine and has been actively involved in efforts to support Ukraine, including through the February 24, 2023 announcement of another important round of sanctions on Russian goods, entities and individuals. We address these further developments in this bulletin, along with additional sanctions imposed by Canada in respect of Haiti, Iran, Myanmar and Sri Lanka.

New Sanctions Mark the Year Since Russia’s Further Invasion of Ukraine

In its latest round of sanctions, Canada sanctioned another 129 individuals and 63 entities[1]. The individuals include senior managers of Russian defence companies and senior officials in the Russian government. Listed entities include defence companies, IT companies, and companies in the oil and gas industry, including Rosneftgaz, one of Russia’s largest companies. Other entities designated for supporting Russia’s war include United Russia, a conservative Russian political party, the State Duma, and the Russian Federation Council.

Canada has prohibited the import, purchase or acquisition of any type of weapon, ammunition, military vehicle or military equipment, or spare parts of any of these goods from Russia or any person in Russia. As a practical matter, Canada imports almost no such goods from Russia so these measures are largely symbolic.

Canada also added “chemical elements doped for use in electronics, in the form of discs, wafers or similar forms; chemical compounds doped for use in electronics” to the list of goods prohibited from being exported to Russia because of their potential use in the manufacture of weapons. However, this prohibition may also be largely symbolic as Canada has not exported these goods to Russia since 2019. The use of doped elements in electronics allows for the creation of materials with controlled electrical conductivity, making them essential for developing modern electronic devices like semiconductors.

Canadian Firms Subject to US Trade Restrictions

On the same day as Canada introduced its new round of sanctions, the US Department of Commerce added two Canadian firms to the Entity List under the Export Administration Regulations (“EAR”)[2]. The firms, CPUNTO Inc. and Electronic Network Inc., are both located in St. Laurent, Quebec and both are distributors of electronic components. According to the Department of Commerce, these firms “significantly contribute to Russia’s military and/or defence industrial base and are involved in activities contrary to U.S national security and foreign policy interests.”[3]

The imposition of restrictions on Canadian businesses by the United States for their support of Russia is notable. Any US persons looking to do business with these firms on the Entity List will require a licence, which “will be reviewed under a policy of denial for all items subject to the EAR.”[4] This development indicates that the US will use its own legal regime to address by firms in allied countries if those firms are undermining the US export controls or sanctions regimes. Canadian businesses that have not fully ceased all potential contributions to Russia’s military and industrial base carry significant risk of similarly becoming subject to such restrictions.

International Collaboration on Sanctions: Enforcement Recap and New Developments

The use of economic sanctions as a tool by Canada and other allied governments has increased significantly. However, sanctions enforcement is necessary to ensure that the intended impact of economic sanctions is achieved. Without effective enforcement, sanctions can be circumvented or ignored, undermining their effectiveness and reducing their impact.

Canada continues to participate in the Russian Elites, Proxies and Oligarchs (“REPO”) Task Force alongside the G7, the EU and Australia, which, collectively, have blocked or frozen more than $58 billion worth of Russian assets in financial accounts and economic resources.[5] However, Canada itself has publicly taken few actions relating to sanctions enforcement.

The enforcement climate may be changing through US leadership and pressure. In particular, in an effort to bolster sanctions enforcement, the G7 have proposed an Enforcement Coordination Mechanism (“ECM”).[6] The goal of this initiative is to target countries and persons helping Russia circumvent sanctions via information-sharing, intelligence analysis and coordinated actions among ECM members. The United States will chair the ECM in the first year.[7] As the pre-eminent global enforcer of economic sanctions, via its Office of Foreign Assets Control (“OFAC”), the United States appears to be signaling that other countries should be working in parallel to increase enforcement actions.

Canada Continues to Expand Use of Sanctions Against Other Countries

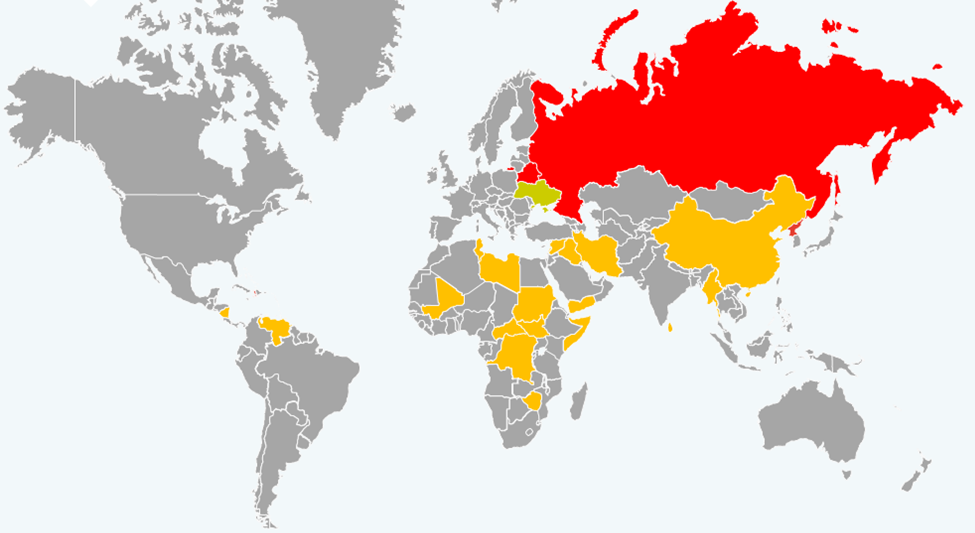

As illustrated in the map below, Canada has imposed sanctions against numerous countries in addition to Russia.

The Lay of the (Sanctioned) Land

In the last year, Canada has imposed additional sanctions against four countries other than Russia, highlighting the Government of Canada’s intent to further develop and rely on sanctions as a tool of economic and diplomatic pressure:

- Haiti: Canada implemented sanctions against Haiti for the first time in 2022 as a result of “unrelenting insecurity and criminality, political turmoil and endemic corruption”.[8] Additional sanctions were imposed on January 12 and February 15, 2023. Sanctioned Haitian individuals generally include members of the “economic and political elite” who have engaged in acts of corruption or provided support for drugs and weapons trafficking. One of the sanctioned persons is the former Prime Minister, Laurent Salvador Lamothe, who has since filed a judicial review application with the Federal Court to be de-listed. Mr. Lamothe argues that the decision to sanction him was unreasonable as it “gives blind credence to unfounded speculation” and also that the decision to add him to the list of sanctioned individuals contravened the rules of procedural fairness.[9] This is the first instance in which the Federal Court will consider the requisite scope of procedural fairness owed to individuals being added to a dealings prohibition under the Special Economic Measures Act (“SEMA”).[10]

- Iran: Canada continues to sanction Iranian individuals. Canada has imposed seven rounds of sanctions against Iran in 2022 and two so far in 2023, most recently on February 23, 2023. In this most recent round, an additional 12 individuals were added to the dealings prohibition in relation to Iran’s gross and systematic violations of human rights against civilian protestors and its own citizens.[11] For more updates on Canada’s sanctions in Iran, see our previous bulletins here and here.

- Myanmar: Sanctions against Myanmar were originally imposed in 2007 after the Saffron Revolution, but many were suspended in 2010 following positive political developments in the country.[12] Following the coup d’etat against the democratically elected government, Canada has again imposed broader sanctions against Myanmar. Most recently, on January 27, 2023, marking the second anniversary of the Myanmar coup, Canada added 6 individuals to the dealings prohibition and prohibited the export, sale, supply or shipment of aviation fuel to Myanmar.

- Sri Lanka: On January 6, 2023, Canada imposed sanctions relating to Sri Lanka under SEMA for the first time. Canada sanctioned four Sri Lankan state officials for human rights violations during Sri Lanka’s civil conflict, which occurred from 1983 to 2009. The individuals include former Presidents Gotabaya Rajapaksa and Mahinda Rajapaksa. The objective of these sanctions is to “exert pressure on the Government of Sri Lanka to end impunity and uphold its human rights obligations” and to “raise the costs, reputational and real, to these specifically identified individuals and to the Government of Sri Lanka of continuing their political obstruction of justice for human rights violations.”[13]

What Lies Ahead

Trade compliance has become more important than ever for Canadian and international businesses. The war in Ukraine has resulted in relentless imposition of economic sanctions on Russia by Canada and other countries, thereby creating a complex and ever-evolving regulatory environment.

Russia’s unjustified and brutal actions have also had knock-on effects on global trade, disrupting supply chains and creating new risks for businesses operating globally. Canadian businesses may find themselves facing unexpected challenges, such as delays in shipping, changes in tariffs (Canada revoked Russia and Belarus’s Most-Favoured Nation tariff treatment, see our previous bulletin here), and difficulties in accessing key markets. Compliance with trade regulations can help businesses navigate these challenges and avoid potentially costly mistakes.

McMillan LLP supports businesses dealing with complex regulatory regimes, including sanctions, export controls and customs, to ensure that they are in compliance at all times.

Previous Bulletins Published Since Russia’s Further Invasion of Ukraine in 2022

- Canada Strengthens Its Economic Sanctions and Export Controls Against Russia and Supports Russia’s Removal from SWIFT (February 25, 2022);

- Canada Ratchets Up its Sanctions in Response to the Russia-Ukraine Crisis (March 4, 2022);

- Canada Further Expands its Sanctions Regime Against Russia (March 29, 2022);

- Canada Expands Sanctions on Russia and Proposes Broad Legislative Changes to its Sanctions Regime (June 1, 2022);

- Canada Clamps Down on Services Provided to Russia (June 13, 2022);

- Services, Sensitive Technologies, Luxury Goods, Gold and Disinformation Sanctions – Plus a Forfeiture Regimes: Canada’s Latest Responses to the Russian Invasion of Ukraine (July 13, 2022);

- Canadian Sanctions Revisited: More Russian and New Iranian Sanctions, Including Price Cap on Russian Oil (October 4, 2022);

- Sanctions Pivot: Canada Seeks Forfeiture of Russian-Owned Assets to Fund Reconstruction of Ukraine and Adds Oil Price-Cap Restrictions (December 22, 2022)

[1] Regulations Amending the Special Economic Measures (Russia) Regulations, SOR/2023-032; Regulations Amending the Special Economic Measures (Russia) Regulations, SOR/2023-033.

[2] Department of Commerce, Bureau of Industry and Security, Additions of Entities to the Entity List, 88 Federal Register 12170 (February 27, 2023), p. 45.

[3] Department of Commerce, Bureau of Industry and Security, Additions of Entities to the Entity List, 88 Federal Register 12170 (February 27, 2023).

[4] Department of Commerce, Bureau of Industry and Security, Additions of Entities to the Entity List, 88 Federal Register 12170 (February 27, 2023).

[5] Department of Finance Canada, Statement on Russian Elites, Proxies and Oligarchs Task Force results, February 24, 2023.

[6] Bloomberg, “G7 Set to Create New Tool to Bolster Enforcement of Russia Sanctions”, February 22, 2023.

[7] White House, Fact Sheet: On One Year Anniversary of Russia’s Invasion of Ukraine, Biden Administration Announces Actions to Support Ukraine and Hold Russia Accountable, February 24, 2023.

[8] Global Affairs Canada, Canada Sanctions Related to Haiti, Background.

[9] Laurent Salvador Lamothe c. La Gouverneure Generale en Conseil et al, T-2697-22, Notice of Application, December 22, 2022.

[10] In Gomez v Canada (AG), 2021 FC 1300, the Federal Court considered the scope of procedural fairness owed to Mr. Gomez in his application to be removed from the list of persons set out in the Regulations to the Justice for Victims of Corrupt Foreign Officials Act (Sergei Magnitsky Law), S.C. 2017, c. 21. (Mr. Gomez was not listed under SEMA.) Mr. Gomez argued that the Minister breached the duty of procedural fairness owed to him with respect to his request to be delisted. In contrast, Mr. Lamothe is arguing that the decision to list him breached procedural fairness.

[11] Regulations Amending the Special Economic Measures (Iran) Regulations, SOR/2023-034.

[12] Global Affairs Canada, Canada Sanctions Related to Myanmar, Background.

[13] Special Economic Measures (Sri Lanka) Regulations, SOR/2023-2, Regulatory Impact Analysis Statement.

by Neil Campbell, William Pellerin, and Tayler Farrell

A Cautionary Note

The foregoing provides only an overview and does not constitute legal advice. Readers are cautioned against making any decisions based on this material alone. Rather, specific legal advice should be obtained.

© McMillan LLP 2023

Insights (5 Posts)View More

Budget 2024: Legislative Changes of Note for Investment Funds

In Budget 2024, the Government acknowledges that the restrictions placed on the property that may be held by registered plans have become unduly complex.

Budget 2024: Clean Energy Incentives and Resource Sector Measures

Budget 2024 prioritizes Canada’s transition to a net-zero economy and contains several measures aimed at facilitating that ongoing transition.

Budget 2024: Synthetic Equity Arrangement Restrictions Tightened

Budget 2024 proposes to tighten the “synthetic equity arrangement” anti-avoidance rule by eliminating the no “tax-indifferent investor” exception.

Budget 2024: Increases in the Taxation of Capital Gains

Budget 2024 proposes to significantly change how capital gains are taxed under the Income Tax Act (Canada).

Budget 2024: Expanded Relief for Non-Resident Service Providers

Budget 2024 will expand the circumstances under which relief may be granted from withholdings on payments made to non-residents that render services in Canada.

Get updates delivered right to your inbox. You can unsubscribe at any time.