Registration Roundup: The Development of Securities Regulation of Crypto Trading Platforms (CTPs) in Canada

Registration Roundup: The Development of Securities Regulation of Crypto Trading Platforms (CTPs) in Canada

The Canadian Securities Administrators (the “CSA”) continue to develop the securities regulatory framework applicable to crypto trading platforms (“CTPs”) operating in Canada, which has been an area of focus for the CSA for several years. As a result, CTPs and other industry participants face an evolving legal environment as they navigate these changes. This bulletin provides a brief summary of the development of securities regulation of CTPs by the CSA, a snapshot of the current state of CTP registrations, and insight into potential future developments in this space.

A Brief History

The CSA consider CTPs to be platforms that facilitate the trading of digital assets (generally referred to as “crypto” or “crypto assets” by the CSA) that are considered securities or instruments or contracts involving digital assets (generally referred to as “crypto contracts” by the CSA), and includes marketplaces, dealers, and business models incorporating elements of both.

The history of Canadian securities regulation of CTPs includes three key developments: (i) the announcement by the regulators of a proposed regulatory framework and consultation period; (ii) the implementation of an interim registration framework; and (iii) the introduction of pre-registration undertakings (“PRUs”).

- The consultation period began with the publication of Joint CSA/IIROC Consultation Paper 21–402 – Proposed Framework for Crypto–Asset Trading Platforms (the “Consultation Paper”) in March 2019. The Consultation Paper outlined a proposed regulatory framework for CTPs and invited comments from industry stakeholders.

- Following this consultation, the CSA implemented an interim registration framework intended to allow CTPs to continue to operate in Canada while the CTPs work towards further compliance with Canadian securities legislation under a long-term regulatory framework. This interim registration framework generally requires CTPs to register as a restricted dealer and apply for exemptive relief from certain requirements under Canadian securities laws.

- Most recently, the CSA introduced the requirement for unregistered CTPs to agree to and file a PRU in order to be permitted to continue to operate in Canada while seeking registration under Canadian securities legislation. The PRU imposes certain terms and conditions on the business and operations of the CTP, including with respect to appropriateness assessments, investment limits, know-your-client (KYC) obligations, conflicts of interest, custody requirements, and reporting requirements, among others. The CSA released the first form of PRU in August 2022. The CSA recently released an “enhanced” form of PRU in February 2023, which includes and imposes expanded terms and conditions, including with respect to the custody of client assets, stablecoin/proprietary token offerings, and a prohibition on offering margin or leverage.

Below is a timeline summarizing certain notable events relevant to the regulation of CTPs in Canada:

Notes:

- See CSA Staff Notice 21–327 – Guidance on the Application of Securities Legislation to Entities Facilitating the Trading of Crypto–Assets.

- See Joint Canadian Securities Administrators / Investment Industry Regulatory Organization of Canada Staff Notice 21–329 – Guidance for Crypto–Asset Trading Platforms: Compliance with Regulatory Requirements.

- See the OSC news release dated March 29, 2021.

- See Joint Canadian Securities Administrators / Investment Industry Regulatory Organization of Canada Staff Notice 21–330 – Guidance for Crypto–Trading Platforms: Requirements relating to Advertising, Marketing and Social Media Use.

- See the CSA announcement dated August 15, 2022.

- See CSA Staff Notice 21–332 – Crypto Asset Trading Platforms: Pre–Registration Undertakings – Changes to Enhance Canadian Investor Protection (“Staff Notice 21–332”) and our bulletin here.

The Current State of Registrations and Pre-Registration Undertakings in Canada

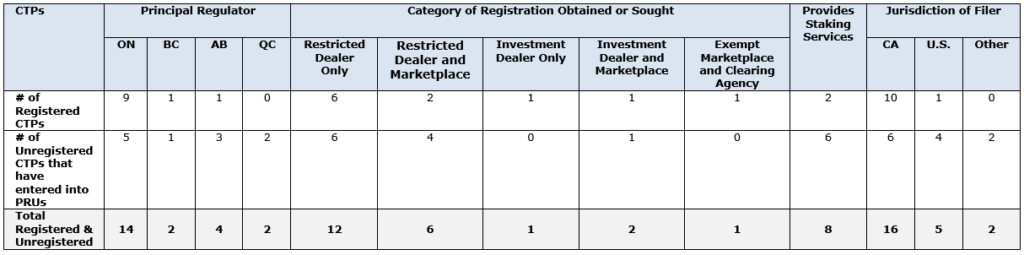

Eleven CTPs have been granted registration pursuant to the interim regulatory framework implemented by the CSA. These CTPs have generally been granted: (i) registration as a restricted dealer; and (ii) exemptive relief from certain requirements under Canadian securities laws, such as the prospectus requirement and the suitability requirement. However, there is notable variance in the registrations and relief granted to these CTPs, such as the granting of exemptive relief from certain marketplace rules to permit CTPs to operate a marketplace and certain CTPs being registered as investment dealers, among other differences.

In addition to these registered CTPs, eleven unregistered CTPs currently operate in Canada under PRUs while they seek registration under the interim framework. Notably, the list of CTPs who have filed a PRU includes several platforms with global operations and some of the largest CTPs by trading volume. [1]

The table below provides a summary of certain characteristics of the CTPs currently registered and those that have filed PRUs (which have been published) with the securities regulators.

In addition, CSA members currently uphold a permanent market participation ban of two CTPs. The ban of these two platforms followed enforcement decisions of the Ontario Securities Commissions (“OSC”) delivered in 2022 (the bans are reciprocated in the other provinces/territories).[2]

What’s Next?

It goes without saying that further developments in the regulation of CTPs in Canada can be expected. In the short term, we can expect:

- Publication of More PRUs: We expect the CSA to publish additional PRUs in due course. The CSA have indicated that additional PRUs filed with the CSA remain under review and the March 24, 2023 deadline set by the CSA for CTPs to file the “enhanced” form of PRU has passed.

- Regulatory Action: Although unregistered CTPs operating in Canada have been subject to significant enforcement actions in the past, the CSA have not initiated any new enforcement action since the March 24th deadline. Members of the CSA have continued to publish investor warnings with respect to unregistered entities operating in the digital assets and crypto industry. The CSA have stated that they will take action against CTPs that do not comply with securities regulatory requirements.

- Unregistered CTPs Continuing to Seek Registration: With respect to the deadline for an unregistered CTP operating in Canada to obtain registration, the PRUs generally include an undertaking given by the CTP to obtain registration and applicable exemptive relief within twelve months from the date of the PRU or application for registration or otherwise cease offering its services to users resident in Canada. However, this timeframe varies across PRUs and the deadline can be waived by the principal regulator of the CTP. Notably, one PRU does not contain a specific timeframe but instead only includes an undertaking to “work diligently and use its commercially reasonable best efforts to advance” through the registration process.

- Expiration of Exemptive Relief Granted to Registered CTPs – Level Playing Field Considerations: Under the interim approach adopted by the CSA, the exemptive relief decisions granted generally expire within two years from the date of the decision. The exemptive relief decisions granted to several currently registered CTPs will expire within the year, with the remaining decisions expiring in 2024 or 2025. As the industry and regulatory framework continue to evolve, we expect that the terms and conditions of these expiring decisions may be updated to address “level playing field” concerns.

- Certain CTPs Withdrawing from Canada: As the regulatory framework continues to evolve, we anticipate that some CTPs may choose to withdraw from Canada and cease offering services to Canadian users, rather than comply with CSA requirements. For example, Binance Holdings Ltd., one of the largest CTPs by trading volume globally, announced on May 12, 2023 that it would be withdrawing from Canada on the basis that regulatory restrictions in the country have made its business “untenable”. Binance’s withdrawal from the Canadian market follows an initial announcement that its Canadian affiliate, Binance Canada Capital Markets, had filed a PRU with the Alberta Securities Commission as its principal regulator on March 31, 2023.

Long-term, we anticipate continued progress towards the implementation of a more longstanding regulatory framework applicable to CTPs. The CSA’s stated goal has been to provide an interim framework to allow CTPs to operate in Canada as they prepare to fully integrate into the Canadian regulatory structure, with the contemplated outcome being CTPs obtaining an appropriate registration for their business activity pursuant to National Instrument 31-103 – Registration Requirements, Exemptions and Ongoing Registrant Obligations and membership with the Canadian Investment Regulatory Organization (CIRO).[3] Details with respect to a longer-term framework have not yet been announced by the CSA. However, the CSA recently announced that they will provide further guidance on the application of the expanded terms and conditions of registration applicable to CTPs operating in Canada, which may provide further insight on how the regulatory framework applicable to CTPs may develop.

About McMillan Crypto

McMillan has a comprehensive understanding of blockchain, cryptocurrency, digital assets and other decentralized technologies. We use an integrative, pragmatic, and proactive approach when providing counsel in connection with an ever-changing regulatory landscape. Our cross-disciplinary team brings together specialists across many fields, including litigation, securities regulation, capital markets, investment funds and asset management, mergers and acquisitions, derivatives, technology, privacy and cybersecurity, intellectual property, consumer protection, anti-money laundering, financial services, tax, and bankruptcy and insolvency.

[1] See here.

[2] Mek Global Limited, and PhoenixFin Pte. Ltd., (operating as KuCoin) and Polo Digital Assets, Ltd. (operating as Poloniex) were the subject of substantial monetary sanctions and a permanent market participation ban for failing to comply with Ontario securities law. For further details, please see the CSA website.

[3] Currently, the New Self-Regulatory Organization of Canada (New SRO), the successor entity to the Investment Industry Regulatory Organization of Canada (IIROC) and the Mutual Fund Dealers Association of Canada (MFDA).

by Jennie Baek and Matthew DeAmorim

A Cautionary Note

The foregoing provides only an overview and does not constitute legal advice. Readers are cautioned against making any decisions based on this material alone. Rather, specific legal advice should be obtained.

© McMillan LLP 2023

Insights (5 Posts)View More

Budget 2024: Legislative Changes of Note for Investment Funds

In Budget 2024, the Government acknowledges that the restrictions placed on the property that may be held by registered plans have become unduly complex.

Budget 2024: Clean Energy Incentives and Resource Sector Measures

Budget 2024 prioritizes Canada’s transition to a net-zero economy and contains several measures aimed at facilitating that ongoing transition.

Budget 2024: Synthetic Equity Arrangement Restrictions Tightened

Budget 2024 proposes to tighten the “synthetic equity arrangement” anti-avoidance rule by eliminating the no “tax-indifferent investor” exception.

Budget 2024: Increases in the Taxation of Capital Gains

Budget 2024 proposes to significantly change how capital gains are taxed under the Income Tax Act (Canada).

Budget 2024: Expanded Relief for Non-Resident Service Providers

Budget 2024 will expand the circumstances under which relief may be granted from withholdings on payments made to non-residents that render services in Canada.

Get updates delivered right to your inbox. You can unsubscribe at any time.